In the world today digitalization and automation are the key tools used to fight the rising security problems of the current day. Identity theft, invoices that had swapped account numbers and simple human errors are the cause of many payment related issues that in their turn cause a lot of frustration or in the worst case scenarios, a serious financial hangover.

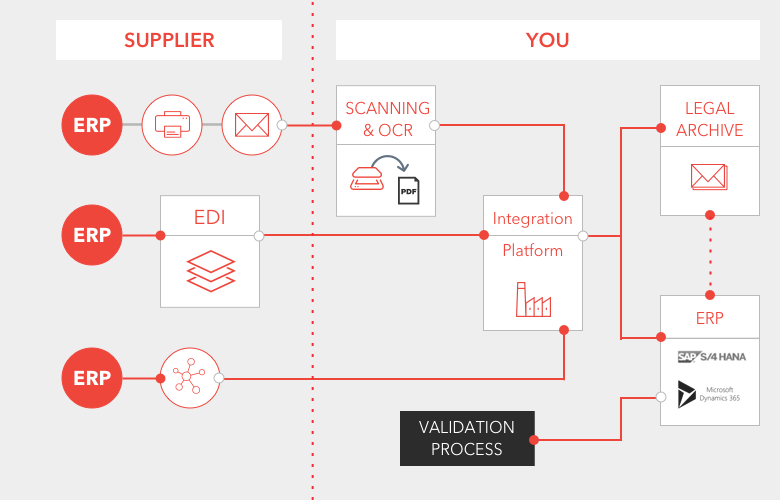

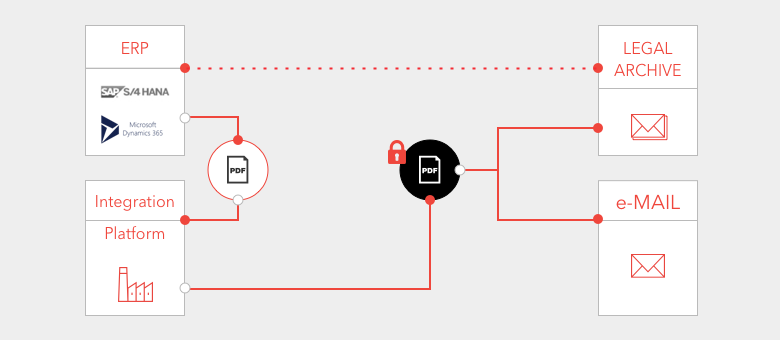

Enter E-Invoicing! When delaware started with E-Invoicing many years ago it already covered the main aspects that our solutions still holds today: paperless, secure and technology agnostic. Whether you’re running on SAP or Microsoft, whether you want to automate your accounts payable or accounts receivable and no matter in what stage you are currently, delaware offers it’s E-Invoicing solutions to fulfill all your electronic invoicing needs.